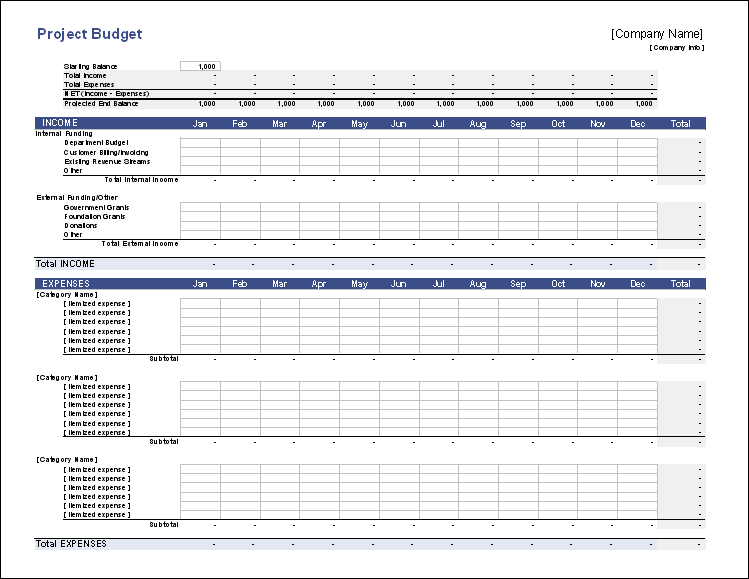

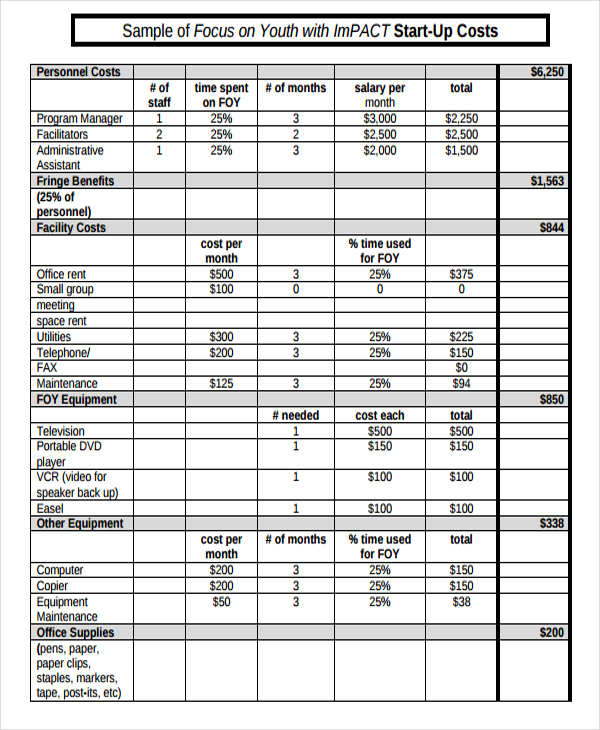

This includes being able to process your data into graphs and charts for comprehensive reports. In order to better understand these figures, it’s helpful to have the interactive visualization feature. When it comes to budgeting, it’s expected that you’ll be working with several screens of numbers and statistics. Through past and present report analytics and statistics, you become better equipped to handle what comes next for your company. These are most especially useful when adjusting and changing the organizations’ revenues, expenses, cash flow and more. Thanks to “what-if” analyses, you can now plan for future projects and budgets. Additionally, this is helpful in visualizing your account balances in any existing financial institution. Through this feature, you’re equipped to adjust your savings and expenses. This means being able to identify where income is coming from and where your expenses are being spent on.

The money management feature refers to the ability to collect and track your company’s cash flow.

#BUDGET PLANNING PROGRAM FREE#

Here are the most sought-out features in free budgeting software: Money management Its features include budget alerts, investment tracker and a budgeting goal tracker.

It provides you with an easy-to-navigate and user-friendly interface, complete with simple to understand graphics as well.Īdditionally, Mint’s entire system is catered around budgeting and tracking expenses, creating and managing goals and lastly, monitoring credit score. Mint, a free cloud-based budgeting platform, focuses on budgeting your financial statements, creating financial goals and aggregating all financial accounts.

Some of them include being able to check your credit scores, get monitored and notified in the event of a critical issue and even extract important documents from Excel and other applications.

#BUDGET PLANNING PROGRAM SOFTWARE#

They do this through a multitude of available features, depending on which software vendor you use. With its intuitive dashboard and management tools, you can see all your accounts, credit scores and balances in one screen.įree online budget software solutions have several functionalities that are useful in maintaining and managing financial tasks and obligations. Mint is a budgeting and financing application suitable for both personal and business use. They have fewer features as compared to ERP solutions but still have good core functionalities, which is to track your spending, pay when bills are due and suggest strategies to reach financial goals. You can use this type of software for your business or as a personal finance software. The users don’t need to pay for maintenance or updates and the vendor is responsible for installation, updating and maintenance. Software-as-a-service budgeting platforms are often cloud-based and offer free basic plans. On-premise budgeting systems are usually purchased by large enterprises and covered by a single license. They differ in terms of the price, industry and deployment. If you’re looking for a solution designed to simplify the budgeting process and create a spending plan but can’t pay for it, then a free budgeting solution is the best option.īefore looking for a specific software provider, you need to differentiate the type of budgeting tools available. For organizations that can’t afford the full-scale and feature-rich budget management systems, free budgeting solutions are made available in the current market. It’s most efficiently used by small businesses, individuals and startups. The software helps automate processes, ensure that all information is available and accessible through a cloud-based platform and ensures that budgets are adhered to accurately. Free budgeting software is an essential solution for helping businesses of any size balance and budget their spending, direct finances and monitor transactions.

0 kommentar(er)

0 kommentar(er)